Moody’s Downgrades U.S. Credit Rating: Does It Really Matter for Markets ?

On Friday, Moody’s Ratings became the final member of the “Big Three” to strip the United States of its pristine Aaa credit rating, downgrading it to Aa1. This decision, while symbolically significant, raises the question: Does it actually matter for markets, rates, or recession risks?

Let’s dissect this event across three analytical dimensions:

A. Moody’s Finally Moves: A Lagging Confirmation of Structural Fiscal Concerns :

Moody’s downgrade echoes the rationale offered by S&P in August 2011 and Fitch in August 2023—namely, that U.S. fiscal policy is on an unsustainable trajectory. Despite its reserve currency status and immense economic scale, the U.S. government continues to run widening deficits with no credible long-term plan to stabilize debt as a share of GDP.

Key themes cited across all agencies:

Persistent fiscal deficits above 6% of GDP.

Rising interest expense burden (now approaching $1 trillion annually).

Political gridlock preventing structural tax or entitlement reform.

This downgrade is not a surprise—it’s a formal acknowledgment of what markets have already priced in: U.S. fiscal credibility is weakening, even if its debt remains the most liquid and desirable collateral globally.

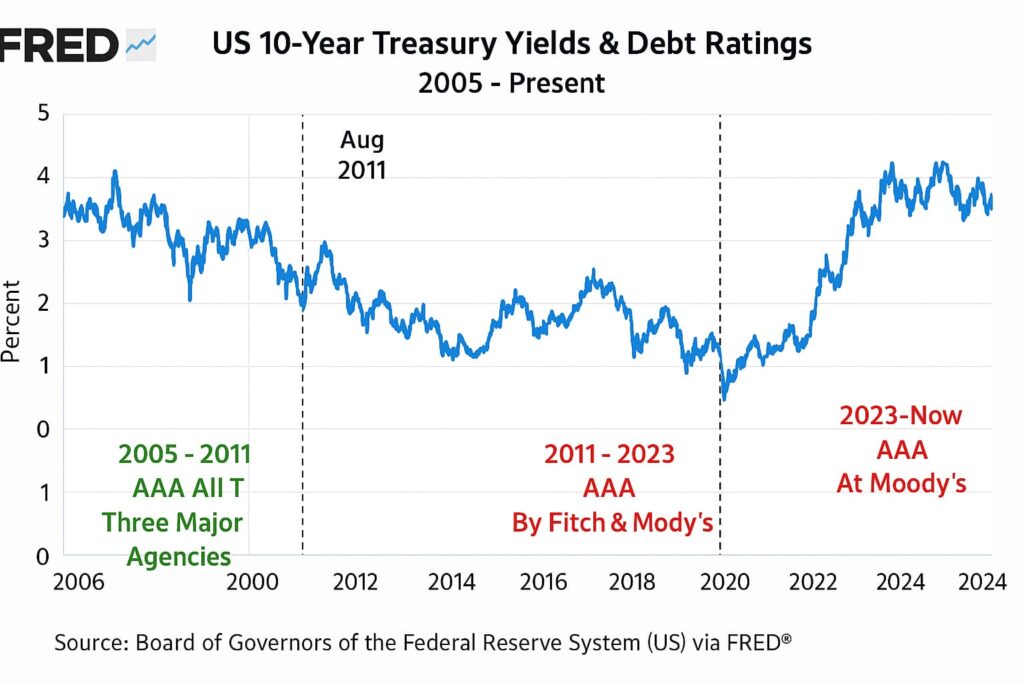

B. Treasury Yields and Ratings: The Historical Disconnect

- Higher Ratings, Higher Yields: Ironically, the highest yields occurred in the mid-2000s when the U.S. had a clean AAA rating across all agencies. From 2005–2007, 10-year yields consistently topped 5%, despite the gold-standard credit status. This was a function of tighter monetary policy, not credit risk.

- Downgrades ≠ Recessions: Neither S&P’s 2011 downgrade nor Fitch’s 2023 action preceded a recession. The post-2011 period saw a decade-long economic expansion. Similarly, despite widespread fears in 2023, the U.S. economy continues to grow, defying recession calls.

- Ratings ≠ Market Signals: Both past downgrades coincided with multi-year bull markets in U.S. equities. S&P’s move in 2011 preceded a near doubling in the S&P 500 by 2015. Fitch’s downgrade in 2023 was followed by market resilience. Credit rating shifts have not been predictive of asset prices.

C. U.S. Debt: Still the World’s “Least Ugly” Safe Asset

While no longer triple-A at any major agency, U.S. Treasurys remain the bedrock of global finance. Why?

- Liquidity: $25+ trillion in marketable debt with the deepest secondary market.

- Dollar Dominance: The U.S. dollar is involved in ~88% of global FX transactions.

- Collateral Utility: Treasurys remain eligible in repo and central bank operations regardless of minor rating moves.

Only a small group of countries—Australia, Germany, Norway, Singapore, among others—retain AAA status. But none match the U.S. in market size, accessibility, or global role.

Final Thoughts: The Downgrade is Symbolic, Not Systemic

The Moody’s downgrade is a headline event, not a macro turning point. History suggests:

No directional signal for interest rates;

No predictive value for recessions;

No correlation with equity downturns.

Investors would be wise to treat this as a wake-up call for policymakers, not a portfolio-altering event. The true risk lies not in the downgrade—but in continuing to ignore the structural imbalances it reflects.