Gold’s 43% Rally: What History Tells Us About the Road Ahead

Gold has always been more than just a metal. And right now, it is glittering brighter than ever, up 42.9 percent in the past year.

Gold has always been more than just a metal. And right now, it is glittering brighter than ever, up 42.9 percent in the past year.

The July 2025 CPI report confirmed what markets had been hoping for: U.S. annual inflation slowed to +2.7% year-on-year, still above the Federal Reserve’s 2% target but comfortably below recent peaks. However, beneath that headline lies a more stubborn challenge for policymakers — wage growth. At +3.9% y/y, wages are still rising faster than prices, meaning real purchasing power…

The market is calm — for now. But is that a sign of strength or the eye of the storm?

After a turbulent first half of 2025, U.S. equities have surged to record highs.

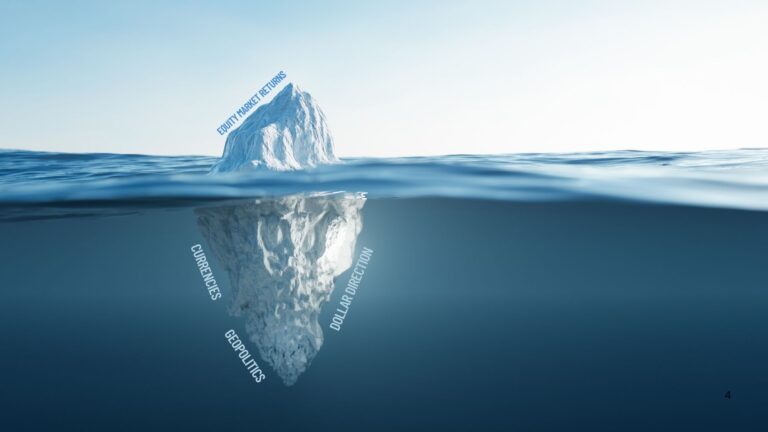

If you had just woken up after a six-month digital detox, peeking at YTD returns in global markets might lull you into thinking 2025 has been a relatively uneventful year. But beneath the surface, the story is far more dynamic — driven less by earnings or innovation and more by shifting tides in currency markets…

Geopolitical shocks, especially military conflicts, present a particularly difficult challenge for investors—not because markets fail to price them in, but because they price them in too fast. While humans tend to focus on present chaos and fear, markets are already processing tomorrow’s possibilities. This divergence often leads to emotional, flawed investment decisions precisely when cool-headed…

As the June 2025 FOMC meeting approaches, the U.S. Federal Reserve finds itself at a critical inflection point—not just economically, but institutionally. With just eight scheduled meetings left in Jerome Powell’s term as Chair, markets are not only watching policy signals but also reading between the lines of a legacy in formation. The Fed’s updated…

May 2025 marks a pivotal moment in global equity performance: for the first time in over 15 years, rest of world (ROW) stocks have outperformed the S&P 500 by the widest margin on record over a 100-day trailing period. This development raises critical questions for global asset allocators: Is this a statistical anomaly destined to mean revert, or the…

On Friday, Moody’s Ratings became the final member of the “Big Three” to strip the United States of its pristine Aaa credit rating, downgrading it to Aa1. This decision, while symbolically significant, raises the question: Does it actually matter for markets, rates, or recession risks? Let’s dissect this event across three analytical dimensions: A. Moody’s…

As of early May 2025, the gold/silver ratio stands at an extraordinary 102x, a level rarely seen outside of historic crises. This ratio—simply the price of gold divided by the price of silver—serves as a real-time barometer of market sentiment. Right now, it’s flashing a powerful signal: investors are prioritizing safety and value preservation over industrial…

The April 2025 U.S. jobs report delivered a measured dose of optimism for markets and policymakers alike, painting a picture of a labor market that’s neither too hot nor too cold — just right enough to keep the Fed steady-handed, at least for now. 1. Labor Market Holding Firm: Job Gains Beat Expectations U.S. employers…