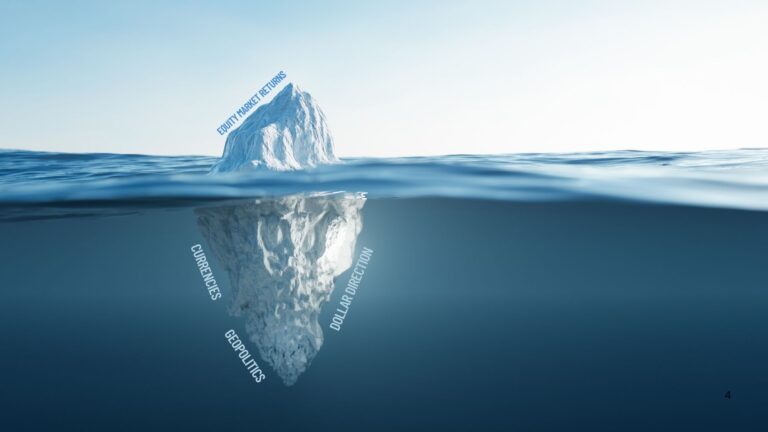

Dollar Historical Cycle During Expansion & Crisis Periods

Recent volatility in the US dollar, particularly its decline in recent weeks, warrants closer inspection through a long-term historical lens. Using year-over-year changes in the Nominal Trade-Weighted Dollar Index (2007–Present) as a benchmark, we draw three analytical insights:

1. Dollar Strength Is a Crisis Signal

Historically, pronounced dollar appreciation has coincided with episodes of acute macroeconomic stress. The dollar’s role as the world’s reserve currency and its safe-haven status have reliably led to capital inflows during heightened global uncertainty. Key examples include:

- 2008–09 Global Financial Crisis: +22%

- Post-2011 Greek Debt Crisis: +10%

- 2015 Global Growth Scare: +17%

- Late-2018 Fed Misstep (tightening into slowdown): +8%

- 2020 Pandemic Onset: +10%

- 2022 Fed Rate Shock: +12%

These episodes reaffirm the dollar’s status as a macro barometer—strengthening when risk appetite collapses and global capital seeks refuge.

2. Dollar Weakness Tends to Mark Transitions in the Global Cycle

In contrast, periods of sustained dollar depreciation have tended to occur:

- At the start of new global expansions (e.g., post-2009 recovery), or

- At the mature stages of an economic cycle, when capital rotates abroad amid synchronized global growth.

Examples include:

- 2002–08 Expansion Endgame: -10%

- Post-Great Recession Recovery (2010–11): -10%

- Late-2010s Expansion Peak: -8%

- Post-Pandemic Normalization (2021–22): -9%

These cycles reflect risk-on global behavior, where investors reallocate capital toward higher-beta assets and emerging markets, and central banks abroad begin to normalize policy in response to global demand.

3. Recent Declines Appear Significant, But Are Statistically Modest

Despite recent volatility, the dollar is essentially flat on a 12-month rolling basis, down just 0.1%. While the velocity of the decline over recent weeks is notable, its magnitude remains well within historical norms. In other words, markets are reacting to short-term noise, but structurally, the dollar has not yet broken out of its broader range.

Strategic Implications: Competing Narratives on Dollar Weakness

Takeaway 1: Crisis or Structural Erosion?

The dollar’s failure to rally during what appears to be a period of elevated uncertainty—driven by volatile equity markets, ambiguous US trade policy, and latent recession fears—marks a break from historical crisis dynamics. Some may interpret this as an early signal of erosion in the dollar’s reserve currency premium, a risk amplified by increasingly unpredictable US policymaking, fiscal imbalances, and perceived encroachments on Fed independence.

Takeaway 2: Global Reflation as an Alternate Explanation

Alternatively, dollar weakness may signal a late-cycle global expansion, spurred not by optimism but by defensive stimulus in other large economies. Governments in Europe and Asia, facing external demand uncertainty, are turning to targeted domestic stimulus, not the indiscriminate fiscal measures of a crisis, but rather calculated policy aimed at sustaining growth through a challenging trade environment.

Takeaway 3: Market Behavior Supports the Reflation Thesis

Global equity performance—particularly in non-US markets—aligns more closely with the reflation narrative. Outperformance in EM and European equities suggests a capital shift toward cyclical and valuation-sensitive regions, consistent with a world betting on incremental global growth, rather than one hunkering down for systemic risk. Historically, true moments of panic are accompanied by a dollar surge, not a retreat.