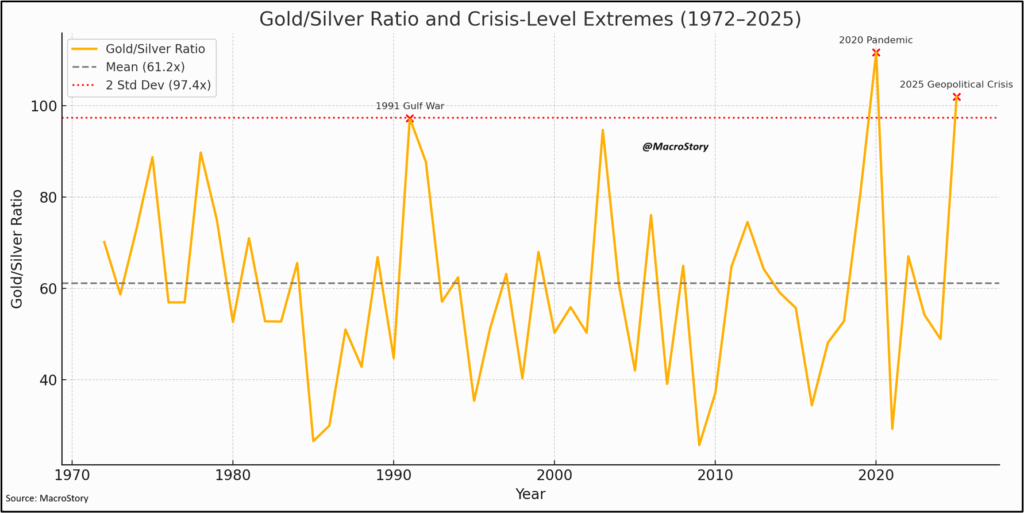

Gold/Silver Ratio Hits Crisis-Era Extremes: What It Tells Us About 2025’s Market Psychology

As of early May 2025, the gold/silver ratio stands at an extraordinary 102x, a level rarely seen outside of historic crises. This ratio—simply the price of gold divided by the price of silver—serves as a real-time barometer of market sentiment. Right now, it’s flashing a powerful signal: investors are prioritizing safety and value preservation over industrial growth optimism.

Historical Perspective: Gold/Silver Ratio in Context

Since the U.S. went off the gold standard in 1971, the average gold/silver ratio has been 61.2x, with a standard deviation of 18.1. That means today’s level of 102x is nearly 2.25 standard deviations above the mean, a threshold only breached during:

- February 1991: Gulf War I, which disrupted oil markets and elevated global uncertainty.

- March – June 2020: The COVID-19 pandemic, when risk-off sentiment and liquidity stress pushed gold sharply higher while silver lagged.

- Now, in 2025: Ongoing geopolitical tensions, trade fragmentation, and central bank hedging behavior.

The current ratio is not just statistically extreme, it is a powerful macro signal. It reflects how fear and uncertainty continue to dominate market narratives.

Gold: The Relentless Store of Value

Gold’s role in the current environment is clear. It remains a trusted store of value, particularly for:

- Central banks, especially non-Western institutions, which see gold as a non-sanctionable reserve asset.

- Investors, looking to hedge against inflation, currency debasement, and systemic risk.

- Wealth preservation buyers, especially amid shifting dollar hegemony narratives.

Only 5–6% of gold demand is industrial, making it less vulnerable to cyclical downturns. This detachment from global manufacturing cycles gives it resilience during economic shocks—exactly what we’re seeing now.

Silver: The Industrial Precious Metal Left Behind

Silver, while also a precious metal, is 60% driven by industrial demand, including electronics, solar panels, and automotive sectors. As such, it behaves more like a pro-cyclical asset, susceptible to:

- Slowdowns in global trade and manufacturing.

- Weakening consumer demand.

- Delays in infrastructure and energy transition spending.

These factors explain why silver has underperformed despite rising gold prices. In effect, recession fears and industrial demand fragility are suppressing silver’s upside.

The Case for a Reversal: Silver’s Catch-Up Potential

Despite the current imbalance, the gold/silver ratio is not static. Historically, when the ratio reaches such extremes, it tends to mean-revert—often swiftly—once:

- Geopolitical risks fade.

- Economic confidence rebounds.

- Industrial production picks up.

In other words, silver tends to outperform gold during recovery phases. The 102x ratio offers investors a compelling contrarian setup—a classic case of relative value positioning for the next phase of the cycle.

Takeaways

1. Crisis-Level Ratio

- The current gold/silver ratio (102x) sits at levels only witnessed during major global crises.

- It reflects investor preference for safety, not cyclical growth.

2. Gold Validates Its Role

- Central banks and private capital continue to treat gold as a store of value immune to sanctions and systemic collapse.

3. Silver: A Post-Tension Opportunity

- Once trade and geopolitical tensions ease, silver is statistically and cyclically well-positioned to rally versus gold.

4. Mean Reversion Watch

- A return to the long-term mean (61.2x) implies massive outperformance potential for silver—should conditions normalize.