Gold’s 43% Rally: What History Tells Us About the Road Ahead

Gold has always been more than just a metal. It’s a storybook that reflects our fears, our hopes, and our crises. When confidence in governments or currencies wavers, gold shines as the fallback. And right now, it is glittering brighter than ever, up 42.9 percent in the past year—its biggest surge in over a decade.

But how unusual is this run? And what does history suggest about where prices could go from here? Let’s step back, put today’s move into context, and see what lessons we can carry forward.

From 1975—when Americans were once again allowed to own bullion—gold has averaged an 8.2% annual return with an extremely wide 24.2 percentage point standard deviation. That volatility means one-year returns have often been far from the mean. In fact, rallies of 32–56% fall within “normal” ranges of historical performance.

At today’s 43% year-over-year gain, gold sits neatly between those bands—an unusually strong but not unprecedented move.

Now narrow the lens to the 21st century, and the picture looks even more striking. Since 2000, gold’s average annual gain is 10.9%, with less volatility (15.9 points). In this more stable era, a 42% rally sits exactly at the 2-standard-deviation boundary. In other words, this year’s performance is statistically exceptional, rivaling only a handful of other peaks.

Then vs. Now: The Big Runs That Defined Gold

Gold’s greatest chapters have always been tied to moments of upheaval.

The 1979–1980 “Super Cycle”

- Inflation was racing from 5% to nearly 15%.

- Oil prices spiked after the Iranian Revolution and the Soviet invasion of Afghanistan.

- Gold’s annual gain topped 197% on a monthly basis.

We are nowhere near that scale today: inflation is easing, and oil prices are down year-on-year.

The 2006–2011 Financial Crisis Rally

- A falling dollar, the Global Financial Crisis, and China’s massive stimulus helped gold nearly triple in five years.

- Near-zero interest rates worldwide cemented its role as a crisis hedge.

The Current Chapter (2022–present)

- Russia’s invasion of Ukraine and the freezing of its reserves by the West changed how non-US central banks view Treasuries. Gold, unlike bonds, can be stored locally and free from political risk.

- Central bank gold demand has doubled, from 10% of flows in the 2010s to around 20% now.

- Add in structural inflation worries—from tariffs to questions over Federal Reserve independence—and investors have every reason to keep gold in their portfolios.

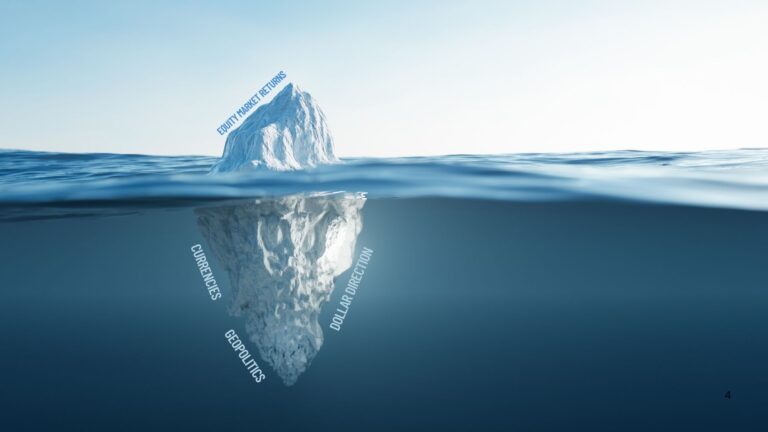

Why Today’s Rally Matters

This isn’t 1979. Inflation is not spiraling into double digits, and oil isn’t wreaking havoc on global economies. But nor is this just another mini-cycle. The shift in central bank behavior is structural: gold is gaining credibility as a “neutral” reserve asset in a multipolar financial world. That’s a profound change that won’t vanish in a year or two.

Moreover, gold’s current role extends beyond fear. It’s about diversification. Investors, both institutional and individual, are increasingly treating gold as a permanent allocation, not a speculative punt. That makes today’s rally more durable than the boom-bust surges of the past.

The Road Ahead: More Upside, but Tempered

Can gold rise another 40% in the next twelve months? Statistically, it’s unlikely—returns of that magnitude are exceedingly rare outside of crisis moments. But can gold continue to climb from here? Absolutely.

- Central banks are steady buyers.

- Global investors remain wary of inflation, tariffs, and political risks.

- Dollar weakness amid Fed easing adds an extra tailwind.

Taken together, this doesn’t spell another “super cycle” but rather a sustained upward path. A slower climb, yes—but one with firmer foundations.

Takeaway

Gold’s 43% rally is historically unusual, but not unfathomable. It places today’s market squarely in the league of past defining moments. The difference this time? The drivers are structural, not just cyclical. That makes the case for continued upside even after such extraordinary gains.

Gold, in other words, is no longer just a crisis hedge. It’s becoming a cornerstone of the modern financial system.

And that’s a story still being written.