Record Outperformance: Rest of World vs. S&P 500 – What’s Driving It and What Comes Next?

May 2025 marks a pivotal moment in global equity performance: for the first time in over 15 years, rest of world (ROW) stocks have outperformed the S&P 500 by the widest margin on record over a 100-day trailing period. This development raises critical questions for global asset allocators: Is this a statistical anomaly destined to mean revert, or the early signal of a structural rotation out of U.S. equities?

Let’s dissect the data and consider what comes next.

1. Understanding the Chart: Relative Returns and Their Significance

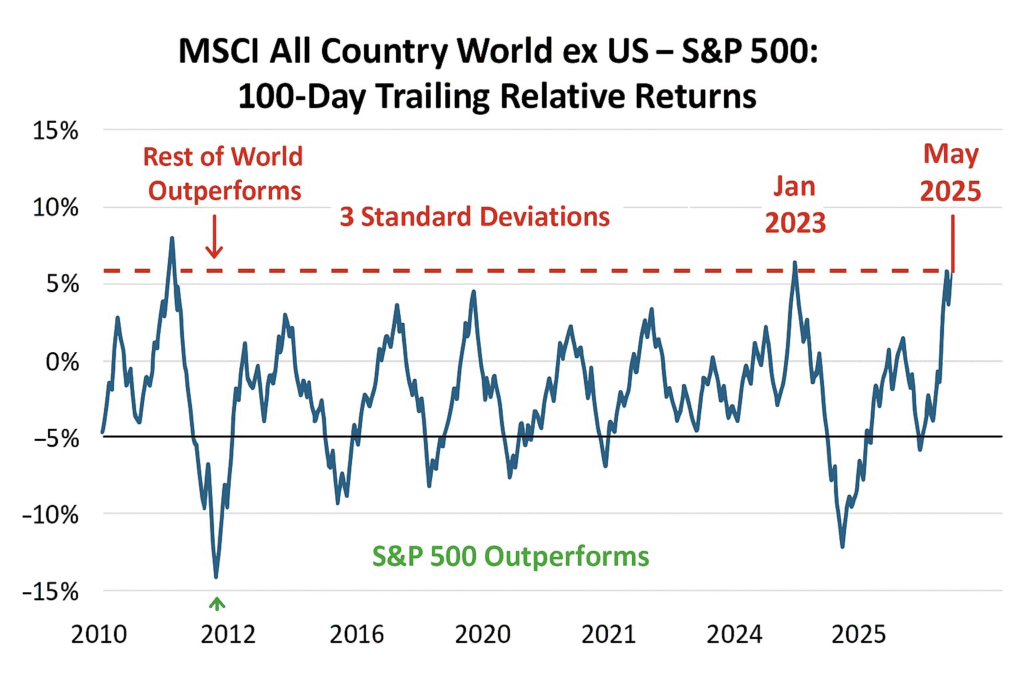

The chart plots the 100-day trailing relative price performance between the ACWX ETF (iShares MSCI All Country World ex-US) and the S&P 500 from 2010 to present. Positive values indicate ROW outperformance; negative values indicate U.S. outperformance.

- Mean underperformance of ROW: ~-3.5 percentage points over 100-day windows.

- Standard deviation: 5.3 percentage points, meaning swings beyond ±10% are statistically unusual.

- Three-Sigma Threshold: Set at +12.4 points, this level has only been breached three times in the last 15 years:

- Oct 2010: ROW outperformed by +12.7 points → underperformed by -7.9 points in the next 100 days.

- Jan 2023: ROW outperformed by +13.5 points → underperformed by -10.1 points thereafter.

- May 2025: Current record high of +15.9 points, a historic deviation from trend.

This rare level of divergence is not just statistically significant—it demands interpretation.

2. What’s Driving the Record ROW Outperformance?

The answer is currency strength. A large portion of dollar-denominated equity gains outside the U.S. comes not from superior local stock performance, but from a weaker dollar.

| Index | Total Return (USD) | FX Contribution |

|---|---|---|

| S&P 500 | +0.3% | N/A |

| MSCI Europe (IEUR) | +22.2% | ~40% from EUR/GBP |

| MSCI Japan | +11.6% | ~75% from JPY |

| MSCI Emerging Mkts | +9.9% | ~40% from EM currencies |

Key Insight: More than half the ROW outperformance is driven by currency effects, not fundamental equity gains. While local markets have posted modest gains, it’s the weakening dollar amplifying USD-based returns.

3. What Comes Next? Lessons from History and Possible Regime Shift

History warns against extrapolating such extremes.

- Post-2010 and 2023 precedents both saw sharp reversals after a 3-sigma outperformance.

- However, May 2025’s divergence is larger than either previous peak, which may suggest that something more persistent is unfolding.

Scenario 1: Mean Reversion

If history repeats, we could see:

- U.S. equities rebound as global outperformance fades.

- Dollar stabilizes or strengthens, eroding the FX-driven tailwind for ROW stocks.

- ROW returns lag over the next 3–6 months.

Scenario 2: Structural Rotation or Regime Shift

Several factors support this alternative view:

- Diversification-driven capital flows out of overconcentrated U.S. tech-heavy benchmarks.

- Rising interest in undervalued international equities and emerging markets.

- Long-term concerns over U.S. fiscal sustainability may weaken dollar structurally.

If such a shift is underway, ROW could continue outperforming, particularly if local earnings improve and currencies remain strong.

4. Portfolio Strategy: Index-Weighting ROW is a Sensible Middle Ground

We’ve advocated for index-weight exposure to ROW stocks (~36% global equity weight) in recent months—and that remains the prudent path.

- Prospect of sustained outperformance: Even if partially currency-driven, current momentum favors maintaining exposure.

- Valuation advantage: ROW equities still trade at lower forward P/E ratios vs. U.S. peers.

- Diversification benefit: Helps hedge concentrated U.S. risk and potential dollar volatility.

Key Point: While timing the top is difficult, being underweight ROW here is riskier than being overweight, given both performance trends and currency dynamics.

This Time May Be Different—But Don’t Bet the Farm

May 2025’s historic outperformance by rest of world equities demands attention—but not overreaction.

- Yes, history warns of reversals after such extreme outperformance.

- Yet, macro conditions today—especially FX dynamics and valuation gaps—create the potential for a sustained shift.

Tactical Conclusion: Maintain or slightly overweight ROW exposure near index weights.

Strategic Thought: Monitor currency markets, global flows, and Fed policy. If dollar weakness persists or accelerates, the “decade of U.S. equity dominance” narrative may be fading fast.