Revisiting the Case for Non-U.S. Equities — A 3-Point Analytical Update

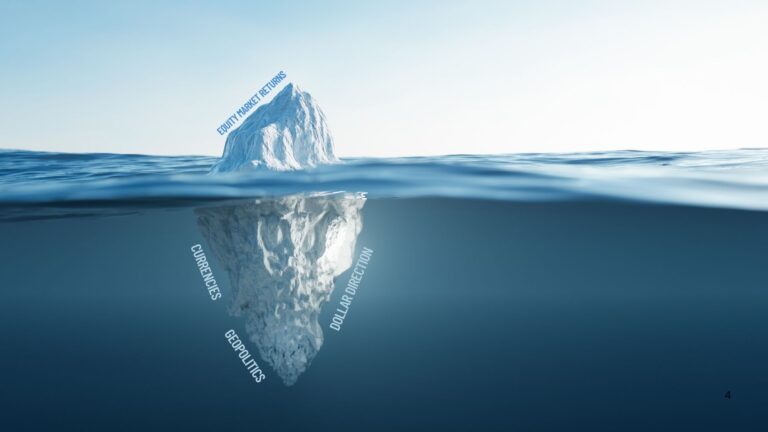

Year-to-date, non-U.S. equities have staged a notable outperformance relative to U.S. markets, with the iShares MSCI ACWI ex U.S. ETF (ACWX) returning +9.0% versus a -6.0% decline in the S&P 500. This relative strength reflects recent macro divergences, including differing monetary policy stances, currency dynamics, and sectoral exposures more favorable to non-U.S. markets.

However, this short-term outperformance must be contextualized within a longer-term structural underperformance. Over the past 15 years, ACWX has delivered a cumulative return of just +39%, while the S&P 500 has surged +368%—highlighting the persistent growth and profitability advantage of U.S. equities, particularly in the technology and consumer discretionary sectors.

Our 3-point analytical case :

1. Long-Term Underperformance Remains the Core Challenge

Over the last 15 years, U.S. equities have vastly outperformed their global peers:

- The S&P 500 is up +368% (price basis) since 2010.

- MSCI EAFE (developed markets ex-U.S.) has returned just +53%.

- MSCI Emerging Markets is down -1% over the same period.

Non-U.S. stocks have only rarely outperformed on a calendar-year basis:

- EAFE beat the S&P in just 3 of the last 15 years (2012, 2017, 2022).

- EM managed 4 years of outperformance (2010, 2012, 2017, 2020).

Comment: U.S. dominance has become so entrenched it’s now part of the investment narrative—“American exceptionalism.” As with all consensus views, the risk is that its usefulness peaks just as popularity does.

2. Diversification Argument: Structurally Weak and Crisis-Exposed

While non-U.S. stocks do offer sub-1.0 correlations to U.S. equities, the diversification benefits are less compelling than often assumed:

- MSCI EAFE–S&P 500 average 100-day correlation: 0.83

- MSCI EM–S&P 500 average 100-day correlation: 0.75

In crisis periods, diversification collapses:

- During the 2011 eurozone crisis and 2020 pandemic, EAFE and EM correlations spiked above 0.90.

Comment: Diversification that vanishes in downturns is of limited utility. Given the persistent return drag, investors may be better off exploring alternatives—e.g., commodities, private equity, or uncorrelated fixed income—to achieve true risk dispersion.

3. Correlation Trends Show Volatility-Driven Mean Reversion

Recent correlation data underscores the transitory nature of dislocations:

- March 4, 2025: EAFE/S&P 500 100-day correlation hit a 15-year low of 0.38, driven by U.S. election-related rallies and subsequent EM catch-up trades.

- As of now: correlation has reverted to 0.84, reflecting renewed volatility.

Emerging Markets show similar dynamics:

- 15-year low in EM/S&P correlations in late Feb 2025, now rebounded sharply.

Comment: These short-term dips were statistical anomalies tied to macro catalysts. Correlations reverted swiftly, reaffirming that long-term structural linkage between U.S. and global equities remains intact.

Final Takeaway: Index Weighting Remains the Optimal Stance

- Overweighting non-U.S. stocks: Unwarranted, given persistent underperformance and structural U.S. advantages (innovation, growth focus, reserve currency status).

- Underweighting: Risky, especially given the policy divergence between the U.S. (fiscal drag, policy inertia) and Europe/China (pro-growth stances).

- Index-weight: The most balanced approach, not due to flawed diversification theory, but as a pragmatic allocation amid shifting return dynamics.