When Headlines Roar and Markets Whisper: Navigating Geopolitical Volatility

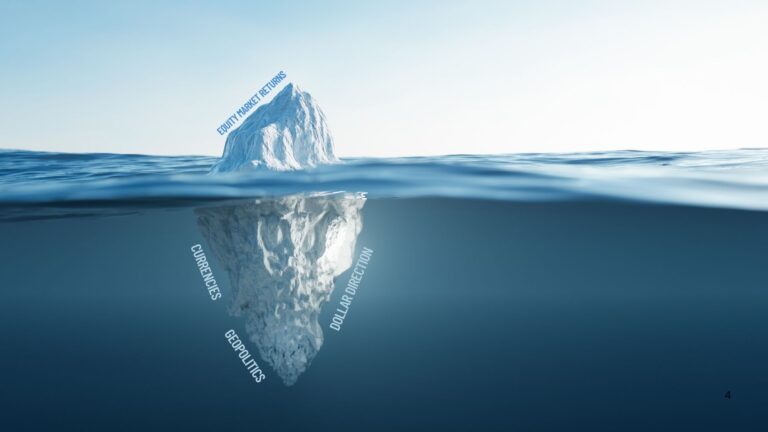

Geopolitical shocks, especially military conflicts, present a particularly difficult challenge for investors—not because markets fail to price them in, but because they price them in too fast. While humans tend to focus on present chaos and fear, markets are already processing tomorrow’s possibilities. This divergence often leads to emotional, flawed investment decisions precisely when cool-headed analysis is most needed.

The Psychological Trap of War-Driven Volatility

The U.S. bombing of Iran’s nuclear facilities over the weekend has flung the markets into a new phase of geopolitical uncertainty. Oil prices are already surging, inflation fears are resurfacing, and equity indices are showing signs of pressure. At first glance, this may feel like the beginning of a downward spiral—and for many investors, it will feel that way.

However, this is where psychology and market structure begin to diverge. While fear dominates headlines and investor sentiment, markets function on expectations, not emotions. This gap is critical to understand.

Markets discount the future: They’re forward-looking engines that rapidly price in 1 to 4 weeks of likely developments.

Humans dwell in the present: Our instincts are tuned to immediate threats, leading to hesitation, panic selling, and delayed entries even when risk-reward begins to favor positioning.

The result? Confusion, uncertainty, and decisions made under duress—none of which typically leads to optimal outcomes.

Historical Compass: Gulf War I and Market Signals

The 1990-1991 Gulf War provides a compelling template for navigating the current moment. While every conflict is different, investor psychology and market structure exhibit surprisingly repeatable patterns.

Here are three critical moments from the 1990 VIX data that can guide us today:

1. The Shock: August 1990 :

Iraq invades Kuwait on August 2, 1990.

The VIX (still new then) spikes from 21.6 to 35.9—a near 2-standard deviation move from its long-term mean (19.5).

Oil prices surge on supply shock fears.

2. The Exhaustion: October 1990 :

Oil prices peak at $41/barrel—the highest since the 1979 Iranian Revolution.

The S&P 500 hits its lowest point for the entire conflict period.

VIX remains elevated (34.0), nearly matching August highs.

Takeaway : Market bottoms tend to coincide with peak fear and peak oil—not with peak violence or military action. Price and sentiment capitulate before resolution arrives.

3. The Turning Point: January 1991

The UN deadline for Iraq’s withdrawal expires.

VIX hits 36.2 again.

The S&P 500 rallies 7% on the day.

WTI crude is already down 26% from its October high.

Takeaway : Markets often rebound before the conflict formally de-escalates. Timing the bottom based on headlines is nearly impossible—price action leads, not follows.

What to Watch in 2025: Oil & Volatility

In the days ahead, two critical indicators will help separate signal from noise:

1. Oil Prices: If Brent or WTI continue breaking higher, risk appetite will remain weak. Watch for signs of stabilization or lower highs in crude.

2. The VIX: A sustained reading above 27.3 (1 standard deviation above the historical mean) signals persistent fear. When paired with non-confirmation in oil (i.e., oil not making new highs), this becomes a strong contrarian setup.

Final Thought: Trade the Disconnect, Not the Drama

Military conflicts are unpredictable by nature—”the enemy gets a vote,” as the saying goes. But markets do not wait for clarity. They bottom in confusion, not confirmation.

It’s never comfortable to buy when headlines are screaming war. But history shows that the most investable lows often occur well before peace is declared. The S&P 500, during Gulf War I, bottomed three months before the first missile was launched and five months before tanks rolled into Baghdad.

Today’s market may not follow the exact same script. But the rhythm—the psychology, the fear, the over-discounting—remains strikingly similar. Watch oil. Watch the VIX. And don’t let headlines blind you to what the market is already whispering about tomorrow.